Cambodian Financial Co-Operatives to better livelihoods

Cambodia’s financial sector was dealt a serious blow in the 1970s when the Pol Pot regime took over the country and abolished not only the National Bank of Cambodia but the national currency as well. Since 1979, the financial sector of Cambodia started gradually rebuilding itself and is now capable of catering to the savings and credit needs of the Cambodian population.

Cambodians have a strong entrepreneurial spirit and work very hard to earn a living through diverse business activities. Many of quickly to accommodate the high demand for loans across the country. The Cambodia Community Foundation Network (CCFiN) has been working towards adding a new dimension to this market and is urging rural populations to shift their focus towards long term savings and savings mobilization through Credit Unions (CUs). Credit Unions are focused on keeping financial resources within the community. This stands in sharp contrast to the plentiful Microfinance institutions (MFIs), banking sector, microcredit market which are profit oriented businesses.

Over the past five years, CCFiN members include registered Credit Unions, community finance association (CFA), and NGOs. CCFiN works with members to provide capacity building, training, and technical support on implementing and sustaining Credit Union for community members, by community members.

Cambodians have a strong entrepreneurial spirit and work very hard to earn a living through diverse business activities. Many of quickly to accommodate the high demand for loans across the country. The Cambodia Community Foundation Network (CCFiN) has been working towards adding a new dimension to this market and is urging rural populations to shift their focus towards long term savings and savings mobilization through Credit Unions (CUs). Credit Unions are focused on keeping financial resources within the community. This stands in sharp contrast to the plentiful Microfinance institutions (MFIs), banking sector, microcredit market which are profit oriented businesses.

Over the past five years, CCFiN members include registered Credit Unions, community finance association (CFA), and NGOs. CCFiN works with members to provide capacity building, training, and technical support on implementing and sustaining Credit Union for community members, by community members.

CCFiN History

CCFiN was founded in 2004 under its former name, the Cambodian Community Finance Network. In 2004 CCFiN also partnered with the Canadian Co-Operative Association in an attempt to broaden the co-operative movement in Cambodia. In 2008, CCFiN officially registered with the Ministry of Interior under the name, Cambodian Community Foundation Network.

CCFiN Mission, Vision, & Goals

Our Mission

To promote sustainable, accessible, and community-owned financial services to rural Cambodian farmers in order to reduce rural poverty.

Our Vision

Develop financial services for rural farmers that allow for economic growth and livelihood improvement.

Our Goal

Provide the necessary support, skills, and capacity for the mobilization, development, sustainability of financial agricultural cooperatives.

To promote sustainable, accessible, and community-owned financial services to rural Cambodian farmers in order to reduce rural poverty.

Our Vision

Develop financial services for rural farmers that allow for economic growth and livelihood improvement.

Our Goal

Provide the necessary support, skills, and capacity for the mobilization, development, sustainability of financial agricultural cooperatives.

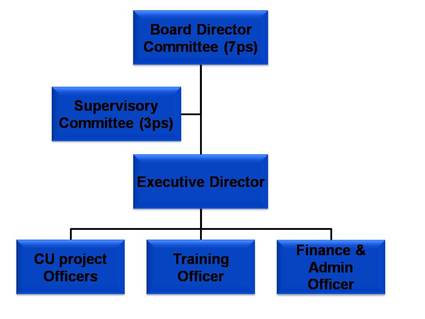

CCFiN Structure

CCFiN Organizational Structure

CCFiN is comprised of a Board of Directors, Supervisory Committee, Executive Director, CU Project Officers, Training Officers, and Finance and Administrative Officers. Together, CCFiN staff and stakeholders continue to promote and develop the rural financial co-operative sector in Cambodia.